INVESTINNEBA TOKEN

NEBA Token is developed by NEXT BASKET, a SaaS platform enabling businesses to easily build and manage online stores. Now, NEXT BASKET is launching NEBA Token to transform global e-commerce.

Join us in revolutionizing e-commerce through blockchain technology and decentralized solutions.

Invest now and help create the next generation of online commerce, with the potential for significant profits after the TGE.

Web2 & Web3 Integration

Seamlessly combining traditional e-commerce with blockchain technology.

Decentralized E-commerce

Transforming online commerce through blockchain innovation.

Multiple Revenue Streams

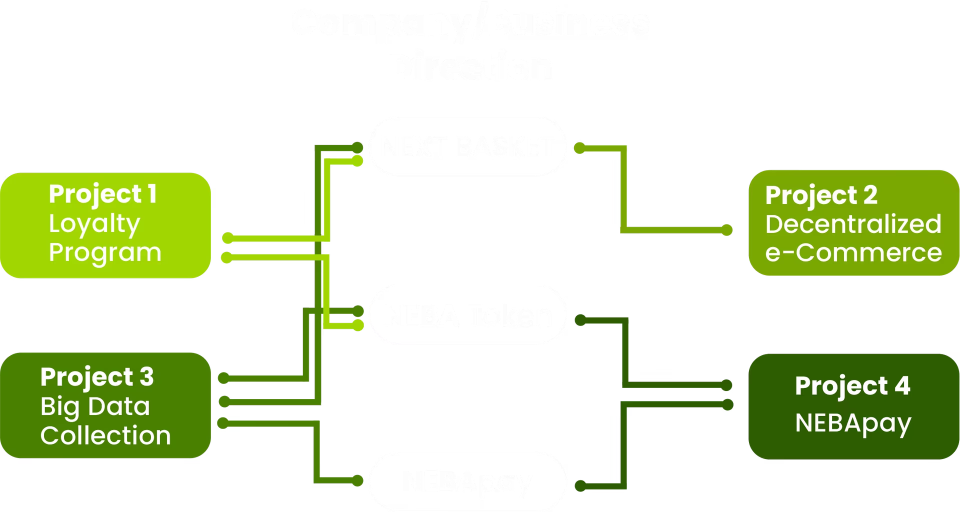

Four standalone projects providing synergistic opportunities.

WHY INVEST TODAY?

Early Bird Advantage

NEBA Token is currently offered to private investors at $0.02 and $0.025, while the TGE price is $0.04, representing a potential increase of up to $70+

Secure Your Spot on the Waiting List

Demand for NEBA Token is rising rapidly. Register now to ensure you can purchase tokens before the official TGE, when the price may be higher and supply limited

Projected Value of $70+

We anticipate NEBA Token to reach at least $70 once all planned projects and functionalities are fully implemented

Real Application

NEBA Token powers the next generation of e-commerce, delivering faster, more secure, and more cost-effective solutions compared to current platforms

Mass Adoption Potential

NEBAPay is envisioned as a global, decentralized crypto payment system built around NEBA Token, providing fast and anonymous transactions. It will leverage millions of existing crypto wallets held by end users in NEXT BASKET online stores, enabling online and offline payments worldwide

WHO IS BEHIND NEBA TOKEN

This is NEXT BASKET, a SaaS e-commerce platform creating online stores for its clients (merchants, store owners), designed to work with NEBA Token. The platform is simple to use and maintain, allowing store owners to design and manage their websites with little or no prior training

ABOUT NEXT BASKET

E-commerce businesses on four continents

35,000 registered platform users

$3 million turnover in first 6 months of 2024

Invest in NEBA Token today and we commit to using all funds raised to improve and expand NEXT BASKET

This will provide an infrastructure where NEBA Token can not only be used for purchases but also generate significant gains for early investors

NEBA TOKEN: 4 CORE UTILITIES

Although they operate within a unified ecosystem, these four initiatives function as independent projects, drawing on the synergy between NEXT BASKET and NEBA Token

1. Innovative Loyalty Program – a key driver for NEBA Token price growth

- •Automatic cashback: Online store customers receive 0.5 back in NEBA Token for each purchase

- •Constant demand: Merchants (online shop owners)must regularly acquire NEBA Token from exchanges to fund these rewards, boosting the token's value

- •Free access to NEXT BASKET: By offering this loyalty scheme, merchants gain complimentary use of NEXT BASKET's services

- •Real impact: With 35,000 stores providing cashback, the potential monthly demand for NEBA Token can significantly affect its long-term value

2. Upcoming decentralized online stores, Marketplace, and Dropshipping platforms

- •Next-generation global e-commerce: NEXT BASKET's decentralized solutions streamline cross-border sales and reduce costs, benefiting both merchants and consumers

- •Faster, cheaper, more secure: No central intermediaries, ensuring transparent transactions via blockchain

- •Mutual growth: The more merchants and products join, the greater the reach and higher the profits for everyone

3. NEBAPay – a global decentralized crypto payment network

- •Scalable solution: Designed to support over 100 million wallets, NEBAPay leverages blockchain for secure, transparent, and fast transactions

- •Easy integration: Payments can be made through mobile apps, wearables, APIs, plugins, or POS terminals, ideal for both online and offline shopping

- •Potential for widespread adoption: With 35,000 stores and an average of 3,000 customers each, NEBAPay can quickly achieve massive distribution

4. Data Collection and Monetization

- •Big Data advantage: Constantly gathering vast amounts of user behavior, purchase preferences, and market trends

- •AI-based analysis: Advanced analytics forecast market changes and help merchants and partners optimize their strategies

- •Potential additional revenue for investors: Selling anonymized, high-quality data to banks, marketing agencies, and other third parties yields extra income that benefits NEBA and may enhance investor returns

DATA FLOW PROCESS

WIN-WIN-WIN SCENARIO

We designed the ecosystem so that every participant gains

Investors

Investors profit from the rising price of NEBA Token.

End Customers

End customers in online stores receive 0.5 cashback in NEBA Token, along with faster, more secure, and more cost-effective e-commerce.

Store Owners

Store owners attract more customers, increase loyalty, and gain free access to NEXT BASKET.

NEXT BASKET solidifies its position as an innovative leader, fueling synergy across the network.

Invest now and help build the first fully decentralized online marketplace, an innovation with massive potential.

Acquire NEBA Token at a significantly lower price before the TGE, with the potential for substantial growth afterward.

Tokenomics

Total Supply: 1,000,000,000 NEBA Tokens

Token Sale

Round | Target | Price | Tokens | FDV |

|---|---|---|---|---|

| Seed / Private | $2,000,000 | $0.02 | 100,000,000 | $20,000,000 |

| Pre-Sale | $2,500,000 | $0.025 | 100,000,000 | $25,000,000 |

| KOL | $600,000 | $0.03 | 20,000,000 | $30,000,000 |

| Public / TGE | $1,600,000 | $0.04 | 40,000,000 | $40,000,000 |

| Total | $6,700,000 | 260,000,000 |

Distribution & Vesting

Direction | % Tokens | Tokens | TGE Unlock | TGE Unlock Total % | Lock up / Vesting |

|---|---|---|---|---|---|

| Seed / Private | 10.0% | 100,000,000 | 0% | 0.0% | 12m lock, 36m vesting 2,777,778 monthly |

| Pre-Sale | 10.0% | 100,000,000 | 0% | 0.0% | 12m lock, 24m vesting 4,166,667 monthly |

| KOL | 2.0% | 20,000,000 | 0% | 0.0% | 12m lock, 6m vesting 3,333,333 monthly |

| Public / IDO | 4.0% | 40,000,000 | 20% | 0.8% | No lock, 6m vesting 5,333,333 monthly |

| Ecosystem Partnerships | 10.5% | 105,000,000 | 10% | 1.1% | No lock, 24m vesting 3,937,500 monthly |

| Team | 10.0% | 100,000,000 | 0% | 0.0% | 12m lock, 36m vesting 2,777,778 monthly |

| Advisors | 3.0% | 30,000,000 | 0% | 0.0% | 12m lock, 36m vesting 833,333 monthly |

| Airdrop | 3.0% | 30,000,000 | 0% | 0.0% | 12m lock, 12m vesting 2,500,000 monthly |

| Reserve | 25.0% | 250,000,000 | 10% | 2.5% | No lock, 24m vesting 9,375,000 monthly |

| Incentives | 15.0% | 150,000,000 | 0% | 0.0% | Special, non-linear unlock rules |

| Liquidity | 7.5% | 75,000,000 | 50% | 3.8% | No lock, 12m vesting 3,125,000 monthly |

| Total | 100.0% | 1,000,000,000 | 8.1% |

Win NEBA Tokens

Leave Your Email and Participate in a Raffle with 10 Prizes,

Each Worth 10,000 NEBA Tokens

Frequently Asked Questions

Invest in NEBA Token and become part of the future of decentralized e-commerce!

Contact Us For Private Sale

Have questions about our private sale? Send us a message

and we'll respond as soon as possible